It’s the start of a new year and we are already seeing hints of the change from winter to spring. Depending on whom you ask, people’s favorite seasons can vary widely.

But if there is one season most Americans would probably agree is their least favorite, it would have to be tax season! After all, who enjoys giving a large chunk of their hard-earned money to the federal government? The one saving grace of it all is that 75% of all filers end up with a refund – about $2,100 on average this year, according to the IRS.

So, if you anticipate a refund this year and haven’t yet decided what you will do with it, why not put it toward something that can make a lasting Kingdom impact? WatersEdge has individual investment options and an array of charitable giving solutions you may want to consider by which you can help your favorite ministry spread the love of Jesus and introduce others to His transforming power. Here are three options to consider:

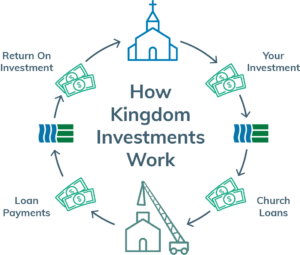

1. Kingdom Investments

Kingdom Investments offers the opportunity to multiply your personal financial resources while simultaneously advancing ministry. The money you invest helps WatersEdge provide loans to churches seeking to purchase, build, renovate, or refinance their facilities. The interest those congregations pay on their loans provides the return on your investment. Currently, the interest rate on a six-month term investment is 5.00% APY. There are great rates available for other term options as well. To open a Kingdom Investment account, sign up online at https://www.watersedge.com/kingdom-investments/ and get ready to watch your money grow! At the end of your term, you can either redeem your principal and the accrued interest or reinvest and continue seeing your investment grow. Learn more in our Offering Circular.*

*WatersEdge securities are subject to certain risk factors as described in our Offering Circular and are not FDIC or SIPC insured. This is not an offer to sell or solicit securities. WatersEdge offers and sells securities only where authorized; this offering is made solely by our Offering Circular. Though not subject to market volatility, investment growth is not guaranteed and is subject to other risk factors as described in our Offering Circular.

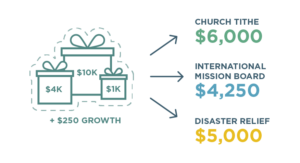

2. Donor Advised Funds (DAF)

If you are looking for a giving solution that can multiply your charitable contribution and provide you with immediate tax benefits, then opening a Donor Advised Fund, or DAF, may be the right move for you! When you open a DAF, it requires little to no paperwork on your part, and you get an immediate tax deduction from the initial investment as well as any subsequent contributions you make to your DAF. Over time, your contributions grow so that you can make donations to any number of qualifying 501(c)(3) organizations or ministries. You can give now and decide which ministries to support at another time. You could give to your church, missions organizations, or your local food bank. There are many other options you might want to consider. Think of it as a savings account for your charitable giving that grows through investment. There are no fees to open a DAF, but the minimum funding amount is $1,000. To learn more or to open a DAF, visit WatersEdge.com/daf.

If you are looking for a giving solution that can multiply your charitable contribution and provide you with immediate tax benefits, then opening a Donor Advised Fund, or DAF, may be the right move for you! When you open a DAF, it requires little to no paperwork on your part, and you get an immediate tax deduction from the initial investment as well as any subsequent contributions you make to your DAF. Over time, your contributions grow so that you can make donations to any number of qualifying 501(c)(3) organizations or ministries. You can give now and decide which ministries to support at another time. You could give to your church, missions organizations, or your local food bank. There are many other options you might want to consider. Think of it as a savings account for your charitable giving that grows through investment. There are no fees to open a DAF, but the minimum funding amount is $1,000. To learn more or to open a DAF, visit WatersEdge.com/daf.

3. Endowment

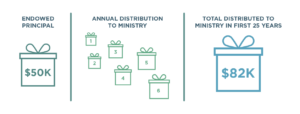

You may have only heard the term “endowment” as it pertains to colleges and universities, but endowments can also be used to support other charities, such as churches and ministries.  Simply put, an endowment is a fund that financially supports a cause or organization forever or until that entity ceases to exist. Investing in an endowment through WatersEdge is another unique way of supporting your favorite ministry during your lifetime and beyond. Each year, WatersEdge distributes a percentage of the endowment’s value to the ministry you support; the remainder continues to grow tax-free to meet future needs. You can also avoid capital gains taxes if your gift is funded with appreciated assets such as stocks or real estate. To get started, go to WatersEdge.com/endowment.

Simply put, an endowment is a fund that financially supports a cause or organization forever or until that entity ceases to exist. Investing in an endowment through WatersEdge is another unique way of supporting your favorite ministry during your lifetime and beyond. Each year, WatersEdge distributes a percentage of the endowment’s value to the ministry you support; the remainder continues to grow tax-free to meet future needs. You can also avoid capital gains taxes if your gift is funded with appreciated assets such as stocks or real estate. To get started, go to WatersEdge.com/endowment.

There are many other smart giving solutions available to individuals and churches aimed at strengthening ministries and advancing the Gospel. Check them out by visiting our website at WatersEdge.com or email give@WatersEdge.com.