Trust Administration

Connect With Our Experts

Help for managing finances. A gift for ministry.

Trust administration empowers WatersEdge to manage your finances on your behalf while you are living and to oversee the settlement of your estate after your death.* These services are designed for single or married senior adults who lack the necessary family support to meet these needs, and who have a strong desire to use their estate for charitable purposes.

Trust administration is an extension of the estate planning process. When you create or update an estate plan through WatersEdge, you’ll have the option to establish a revocable (or irrevocable) trust and designate WatersEdge as your trustee. You may also choose to name WatersEdge as your power of attorney. These designations allow us to manage your finances while you are living, including paying bills, overseeing investments and filing your taxes.

At your death, WatersEdge will coordinate the settlement of your estate, ensuring your possessions are distributed according to your wishes, including charitable gifts to your church or other ministries you wish to support.

*WatersEdge may serve as agent of your estate only if the estate is highly charitable and complies with the Oklahoma Charitable Fiduciary Act (OCFA) and with the WatersEdge Gift Acceptance Policy.

Key Benefits

Never Worry About Managing Finances

As your trustee, WatersEdge will handle day-to-day finances for you — like paying bills, managing investments and filing taxes — for the rest of your life.

Peace Of Mind

Rest easy knowing that you’ve settled important end-of-life decisions by entrusting WatersEdge to carry out your wishes.

Impact Kingdom Causes

After your passing, we’ll distribute your possessions according to your estate plan, ensuring charitable gifts reach the Kingdom causes you’ve chosen.Start Here

Our experienced staff will guide you through the process of designating WatersEdge as trustee.

CONNECT WITH US

Virtually, by phone, or in-person, our giving professionals are ready to help.

SET UP YOUR TRUST

Designate WatersEdge as the trustee and power of attorney of your revocable (or irrevocable trust). Then, transfer ownership of your assets to your trust.

IMPACT MINISTRY

WatersEdge will help you with your finances (paying bills, filing taxes) while you’re living. When you pass, we’ll settle your estate and send your designated gifts to ministry.

Giving Example

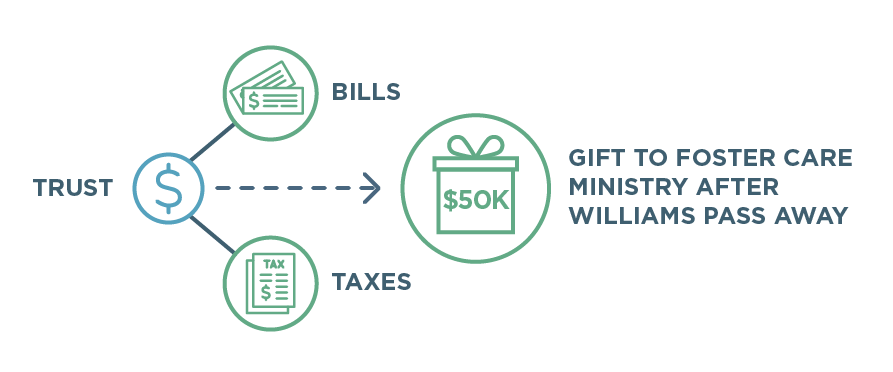

The Williams have always been passionate about foster care. When they created their estate plan, they chose to use their assets to establish a revocable trust, with WatersEdge as the trustee. Now, WatersEdge helps the Williams manage their day-to-day finances — making sure bills are paid and even filing their taxes each year. Plus, they have the peace of mind that comes from knowing that when they pass, WatersEdge will execute their estate exactly as they want, with a sizable portion going to support their foster care ministry of choice.

Trust Administration May Be Perfect For You If:

You want to gift a large portion of your estate to charity.

You'd like support in managing your finances as you age.

You have a revocable (or irrevocable) trust, or are willing to set one up.

You want help coordinating the settlement of your estate.

“When I first started with WatersEdge, it was just for my will. Now, almost 30 years later, my confidence in them has grown. I highly recommend their trust administration services — it’s the best thing I know of for your personal life.”

Margaret Garner

Donor | Oklahoma City, Oklahoma

Talk with our giving experts today.

Review Your Giving Options

When you give generously, the details make all the difference. It’s important to keep in mind your family situation, tax considerations and charitable goals.

Make the right choice with a simple side-by-side comparison.